Latest CPI Tees Up Fed Rate Cut

The only thing that might have been standing in the way between the Federal Reserve and a rate cut this week was last Thursday’s release of the Consumer Price Index (CPI). While the inflation figures weren’t particularly soft, August’s data didn’t reflect a sharp rise in prices either, all but guaranteeing that the Fed will move at Wednesday’s meeting.

Last week, the U.S. Bureau of Labor Statistics, which compiles and releases the inflation data, reported that the CPI rose 0.4% in August, while the core rate, which excludes food and energy, increased 0.3%.

On an annual basis, the CPI accelerated from 2.7% in July to 2.9% in August, the fastest since January. The core rate held steady at a still-elevated 3.1%.

While food and energy obviously have an impact on the cost of living, economists prefer to focus on core inflation because it provides a clearer picture of underlying inflation trends. In part, food and energy can be very volatile. In part, Fed officials tend to use the core CPI to guide monetary policy because it reflects long-term inflation pressures more reliably.

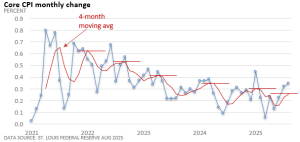

The graphic below illustrates the monthly change in core inflation. Although the four-month average continues to trend downward—evidenced by progressively lower peaks—the pace of decline has slowed as tariffs gradually filter into everyday prices.

Nonetheless, Fed officials have been increasingly concerned about the slowdown in employment growth. They no longer have the leeway they had a year ago, when they could be more focused on inflation.

Most economists expect that the Fed will reduce its key lending rate—the fed funds rate—by a quarter-percentage point to 4.00–4.25%. But a half-percentage point reduction can’t be ruled out.

One year ago, the Fed surprised investors with a half-point rate cut at a time when the labor market was more resilient.

At the time, the Fed framed the decision as a preemptive move. It was insurance against an economic slowdown. Today, the labor market appears to be more fragile, and that has the Fed’s attention.