The Fed Delivers a Long-Awaited Rate Cut

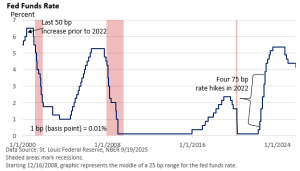

To virtually no one’s surprise, the Federal Reserve slashed the target on its key interest rate—the fed funds rate—at the conclusion of its meeting on Wednesday. The only question regarding the decision was whether the Fed would cut by a quarter point (25 basis points [bp]; 1 bp = 0.01%) or 50 bp. They opted for 25 bp and a new range of 4.00-4.25%.

It is the first rate cut since last December. The vote was nearly unanimous at 11–1, with the dissenter favoring a 50 bp reduction.

At the press conference that followed the meeting, Chair Powell said there “wasn’t widespread support at all for a 50 bp cut.” He described the move as “risk management,” suggesting that while economic concerns shouldn’t be dismissed, they are not too worrisome right now.

What prompted last week’s move? “Labor demand has softened,” Powell said, and the unemployment rate has inched higher.

Yet, he said that tariffs are having some impact on inflation (they are), and that could continue for the rest of the year. However, he added that the pass-through to consumers of tariffs has been “slower and smaller” than expected.

But by moving now, the Fed hopes that lower interest rates will encourage more spending, which supports economic activity.

Yet, inflation is no longer trending toward the 2% target. Nonetheless, the Fed proceeded with a 25 bp rate cut last week and signaled the possibility of further easing this year.

Part of this stance reflects the Fed’s belief that the inflationary impact of tariffs is temporary. Still, if job growth was stronger and the unemployment rate was lower, it seems unlikely the Fed would have reduced rates last week.

Every cycle has its own nuances, but economic growth accompanied by a modest easing by the Fed has historically lent support for stocks.