Reductions in Interest Rates and Market Response—Historical Review

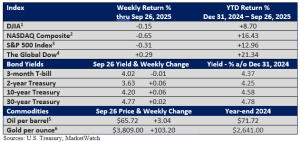

A couple of weeks ago, the Federal Reserve cut its key rate, the fed funds rate, by a quarter-percentage point to 4.00-4.25%. It’s the first rate cut since last December.

So, is this one and done, or will there be a series of rate reductions? A speech delivered last week by Fed Chief Powell wasn’t overly dovish, but the Fed meets two more times this year, and Powell left the door open to at least one more rate cut in 2025.

When the Federal Reserve shifts its policy stance, it often sparks a wave of questions, especially among investors given the Fed’s historical influence on market behavior. One question that comes to mind is how might lower interest rates impact stocks?

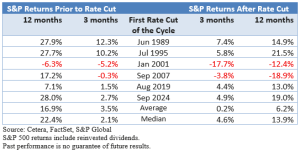

To help answer that, the table below offers a historical perspective on how the S&P 500 has responded to previous rate-cutting cycles.

On average, rate cuts have helped fuel market advances, which is highlighted above.

But there are two glaring exceptions: 2001 and 2007. During those periods, the economy was sliding into a recession as rate cuts began. The 1990 recession began one year after the first cut.

Rate cuts in 2001-02 and in 2007-08 were in response to weakening economic conditions that were leading to a recession. Rate cuts alone were not enough to prevent an economic contraction.

During a recession, corporate profits fall as economic activity declines, more than offsetting any tailwinds provided by a looser monetary policy.

In summary, when the Federal Reserve ‘can’ cut rates, meaning inflation is under control and the economy is stable, it’s often seen as a positive signal. It suggests the Fed has flexibility and can proactively support growth or ease financial conditions. Investors tend to respond favorably because it implies a “soft landing” scenario and continued profit growth.

On the other hand, when the Fed is ‘forced’ to cut rates—typically due to economic distress, recession risks, or financial instability—it’s viewed as a reactive measure. That can trigger concerns about underlying economic weakness, leading to more cautious or even negative market reactions.