One Cut, Two Cut: The Fed’s Delicate Balancing Act

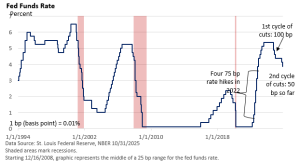

The Federal Reserve delivered a widely expected 25-basis-point rate cut (bp, 1 bp = 0.01%), but Fed Chief Jay Powell tempered market enthusiasm by signaling that a December cut is far from certain. It was the second rate reduction of 25 basis points in the current rate-cutting cycle, which began in September. The fed funds rate is now 3.75–4.00%.

During 2022, the Fed had the ‘luxury’ of focusing solely on inflation, which was partly its own fault after keeping rates too low for too long during 2021. It was painful for investors, but the Fed’s plan was to get inflation back to its 2% annual target.

Note in the graphic that the Fed implemented four consecutive 75 basis point rate increases during that period.

Inflation remains somewhat elevated, running at about 3%, according to the latest US BLS data. However, employment growth has slowed, and the Fed is closely monitoring the labor market.

Are more rate cuts to come? Fed Chief Jay Powell threw cold water on the idea that another rate cut is all but guaranteed at the December meeting.

In his prepared remarks, he stated that there were “strongly differing views” regarding the December meeting. “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it,” he said.

What’s informing the Fed’s thinking? Inflation is not back to its target. While hiring has slowed, layoffs remain low, and economic activity appears to be firming, according to data not compiled by the government (data from government sources is delayed due to the shutdown).

“I think people are saying that they’re noticing stronger economic activity,” Powell said during the Q&A at his press conference. “Forecasters generally, broadly, have raised their economic growth forecast for this year and next year, and in some cases quite materially,” he said.

If forecasts play out, additional rate cuts may not be needed right now. Nevertheless, for investors, an expanding economy supports corporate profits, and so far, Q3 earnings reports have been strong.