Fed Cuts Rates Again, Signals a Possible Pause

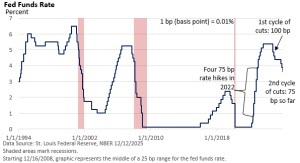

The Federal Reserve followed through on what was a widely expected rate cut, reducing the fed funds rate a quarter-percentage point (1 basis point = 0.01%) to a range of 3.50 – 3.75%.

This is the third rate cut—totaling 75 basis points—in as many meetings. Since the Fed first implemented a rate reduction following a steep series of rate cuts in 2023 and 2023, the Fed has cut its key lending rate by 175 basis points.

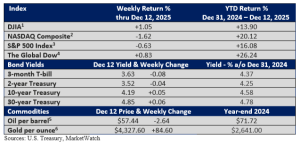

The rate cut was widely expected—no surprise. So, why did the Dow and the S&P 500 Index rally on Wednesday and set new record highs on Thursday (CNBC)?

Moreover, the rally occurred despite an apparent signal that the Fed may forgo another reduction in rates at the late January meeting.

Partly, it may just be how Fed Chief Powell carefully balanced his remarks after the Fed’s decision.

In some respects, it was a hawkish Fed rate cut: reduce the Fed funds rate but signal that the central bank is done for now.

1. Powell said the Fed is “well positioned” (six times) to “wait and see” (four times) regarding whether the economy needs lower rates next year.

2. The statement issued by the Fed, which announced the lower fed funds rate, included language that suggested no more rate cuts, at least at the next meeting. Plus, the Fed’s own projections signal just one rate cut next year. The Fed meets eight times every year.

3. Two of eleven Fed officials opposed a rate cut. Typically, decisions are unanimous.

But Powell smoothed away some of the rougher edges, too.

1. He said no one at the Fed believes the next move will be a rate hike.

2. He highlighted that job growth has been soft, and the economy may actually be shedding jobs, which would suggest the rate-cut option is open.

3. He deemphasized worries about inflation. He believes that inflation related to tariffs could peak sometime in the first quarter, assuming no new tariffs are implemented. Put another way, the mild uptick in the jobless rate seemed to take precedence over bringing inflation back down to the Fed’s 2% annual target.

One more thing that caught investors’ attention: the Fed raised its economic outlook for 2026.

What conditions might prompt the Fed to pursue a more aggressive series of rate cuts?

1. A big slowdown in the rate of inflation.

2. Economic growth stalls.

3. A Fed that becomes much more receptive to the president’s desire for substantial rate cuts.