An Annual Ritual at the Gas Pump You're right if you have this nagging feeling…

Market Commentary, April 29, 2024

The Economy Slows, Inflation Remains a Problem

Gross Domestic Product (GDP) is the broadest measure of goods and services. The U.S. Bureau of Economic Analysis (BEA) reported that GDP slowed from Q4’s annual pace of 3.4% to 1.6% in Q1.

Per the U.S. BEA data, consumer spending eased but remained respectable, while business outlays and residential construction accelerated. A jump in imports shaved one percentage point off GDP. Notably, it’s still too soon to say whether Q3 and Q4’s jump in GDP was just an anomaly.

One-off factors can sometimes add or detract from GDP. In Q1, they detracted, and the 1.6% rate came in below projections, according to Bloomberg News.

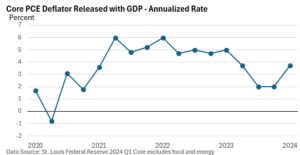

Meanwhile, inflation picked up, as a closely watched measure of underlying inflation rose at a greater-than-expected annualized pace of 3.7%— see graphic below.

Stagflation? That term has popped up a number of times over the last 30 years.

Yes, growth slowed, and inflation accelerated. But it’s only one quarter, and one quarterly data point doesn’t make a trend. Still, inflation is a problem, especially in the service sector, which is more resistant to Fed policy. Few see a rate cut anytime soon.