Tariffs Breach the First Line

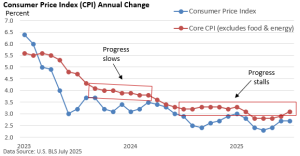

Two important measures of inflation were released last week—both by the US Bureau of Labor Statistics. First, the Consumer Price Index (CPI). It rose a modest 0.2% in July. The core CPI, which excludes food and energy, rose 0.3%. Overall, the report was okay—no significant surge in prices, but no signal that inflation is slowing down either.

More importantly, the latest CPI suggests that tariffs have yet to noticeably affect the general price level. For example, consumer goods excluding food and energy rose just 0.2%. Appliances, which jumped in June, fell sharply in July.

If we dig just under the surface, however, a different story appears to be emerging.

Rarely do we discuss the Producer Price Index (PPI), which is a measure of wholesale prices. The PPI is way out in the weeds. It is primarily a tool for economists.

July, however, was a different story. The PPI soared 0.9% in July, more than triple expectations, per the Dow Jones estimate, and the highest reading since early 2022. The core PPI also recorded an outsized 0.9% rise, triple the forecast.

The sharp rise in wholesale prices suggests that, for now, businesses are largely absorbing higher taxes on imported goods. But it puts us on notice regarding upcoming CPI releases.

Inflation is a broad, persistent, and sustained rise in overall prices. Tariffs on their own aren’t necessarily inflationary—that broad, sustained rise in overall prices—unless the Fed responds with an overly loose monetary policy, like big rate cuts, at least according to economic theory.

Such a response could potentially overheat the economy or trigger a wage-price spiral, similar to the late 1960s and 1970s.

Bottom line—July’s report on wholesale prices was a surprise. However, July is simply one data point—a warning shot, but it’s still just a single point. If August gives way to a similar increase, then we can start connecting the dots; we have a line.

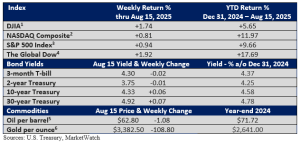

And if it continues for three months, well, that’s when we have a trend. With tariffs and the potential for secondary effects, it’s unclear whether any new trend might be short-lived or not. Today, investors don’t appear to be concerned.