Powell’s Victory Lap Speech (sort of)

Fed Chief Powell’s much-anticipated speech against the picturesque backdrop of the Grand Tetons in Jackson Hole, WY, virtually assures that the Fed will reduce interest rates next month.

In a short 16-minute speech, Powell said the magic words. “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

His words were unmistakable. “The time has come for policy to adjust (change interest rates),” and “the direction of travel is clear (lower).” While he didn’t explicitly mention September, the message wasn’t lost on investors.

How many rate cuts this year (timing) and whether the remainder of the year might bring just quarter-percentage points reductions or something greater (pace of rate cuts) largely depend on what happens with the economic data and economic outlook.

What’s changed? First is inflation. “My confidence has grown that inflation is on a sustainable path back to 2 percent,” Powell said. Rates were raised sharply in 2022 in order to rein in inflation.

But job growth has slowed, too. “The cooling in labor market conditions is unmistakable,” he said. “We will do everything we can to support a strong labor market as we make further progress toward price stability,” informs the evolution in Powell’s thought process.

The new direction implies that the Fed is beginning to question whether today’s rates are too restrictive as well as how many rate cuts may be necessary to achieve the desired level.

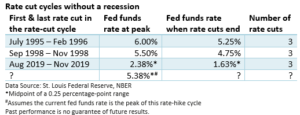

Where to from here? Let’s look at history. Since the mid-1990s, there have been three rate-cut cycles in which the Fed adjusted policy without responding to a recession.

For example, in 1995, the Fed lowered the fed funds rate from 6.0% to 5.25% between July 1995 and February 1996. There were three rate cuts in that cycle.

Notably, these rate-cut cycles were remarkably consistent.

In the absence of a recession, it suggests the Fed won’t begin an aggressive cycle of rate reductions because that risks re-igniting inflation.

How many rate cuts might be forthcoming will largely depend on the economy. Well, how restrictive are rates today? What can be expected in terms of employment and inflation?

The answers to these questions will influence interest rates over the next year.

And no one, including Fed officials, can answer these questions with complete confidence.