An Uptick in the Unemployment Rate

The unemployment rate rose from 4.4% in September to 4.6% in November—see Figure 1. The US Bureau of Labor Statistics did not conduct its household survey in October due to the government shutdown. The household survey includes the unemployment rate.

The rise from the cyclical low of 3.4% to about 4% occurred as workers gradually returned to the labor force following the pandemic, easing labor shortages at the time. The surge in immigration may also have played a role, as more individuals searched for work.

However, since the beginning of the year, the jobless rate has risen from 4.0% to 4.6%, and the rate is up in four of the last five months. By itself, that would signal a recession has likely begun.

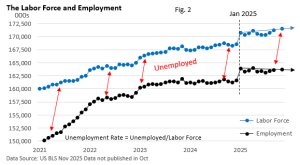

But let’s take a closer look: So far this year, the labor force has grown by 827,000 to 171.6 million, while the number of those employed has declined by 154,000 to 163.7 million, according to the household survey.

Since the number of unemployed is up since the beginning of the year—see Figure 2, the unemployment rate has risen from 4.0% in January to 4.6% in November.

The US BLS roughly defines the labor force as those who are working + the unemployed (not working AND actively looking for work).

Unemployment is climbing partly because job growth isn’t keeping pace with the influx of new workers. The labor force would be expected to rise over time as the population increases.

AI’s impact on hiring, firing

The soft labor market is being blamed on AI, which is reducing the need for workers, at least according to some folks. But is this really the case? Well, it’s not easily quantified.

We’re still in the early stages of AI, and companies still haven’t quite figured out how to fully utilize the new technology.

Still, AI-proficient employees may be viewed as more productive and more creative.

In turn, creativity, which drives innovation, may help generate new sales. AI’s early footprint could result in modest hiring, rather than large job losses.

Another view: AI is a payroll “dampener,” not a destroyer. It raises productivity and shifts tasks, which together slow broad payroll growth without causing large, immediate job losses.

Perhaps tariff uncertainty and somewhat elevated interest rates, along with the desire to stay efficient, may also be affecting employment in today’s uncertain environment. Additionally, the hiring binge that occurred when the economy reopened may be creating a lull in hiring today.

Companies loaded up on employees a couple of years ago and may now be putting the brakes on hiring.

Even so, these observations may provide little reassurance for individuals facing the realities of today’s job market.