An AI Bonanza

Rally mode—that’s been the theme for the major market indexes since the market bottomed out in late 2022. But it comes with a caveat, as we’ll discuss in a moment.

Advancing 14.48% in 2024, including nearly 4% in the second quarter, the broad-based S&P 500 Index has gained ground in every month this year except April, when it shed 4.2%. It has been up seven of the last eight months.

While impressive, the Nasdaq came out on top in Q2 with an impressive 8.26% advance.

An AI Wonderwall

- AI is lifting tech. Investors view AI the way they viewed the internet in the mid-1990s. This has played a significant role in the market’s advance. But let’s not discount other factors.

- Corporate profits have topped expectations, according to LSEG.

- Inflation disappointed early in the year but shows signs of moderating.

- Job growth is solid, the economy is expanding, and the soft-economic landing scenario still appears to be in place.

A rising tide fails to lift all boats—a numerical review

As we observed in 2023, investors continue to be selective in how they have deployed their cash, and the influence of AI cannot be overstated.

The S&P 500 has racked up an impressive gain this year, partly because it is a “market-capitalization-weighted index.” What does that mean? Large companies have a bigger influence on the index than the smaller ones. On average, the big companies have been big winners.

According to S&P Dow Jones Indices, a gauge measuring the top 10 S&P 500 stocks is up nearly 29% since the start of the year, about double the S&P 500’s year-to-date advance.

According to Stock Analysis, those 10 companies account for about one-third of the entire S&P 500 Index. Before a modest pullback in late June, Nvidia (NVDA), which manufactures chips used in AI, accounted for about one-third of the S&P 500’s rise this year (Yahoo Finance).

However, if each stock in the S&P 500 were equally weighted, such a measure would be up a modest but respectable 4.07% this year, according to S&P Dow Jones Indices. In contrast to the S&P 500’s Q2 advance of 3.92%, the equal-weighted measure fell 3.09% in Q2.

Interest rates and stocks

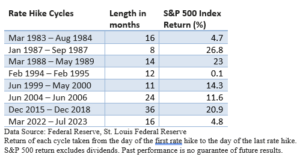

Conventional wisdom holds that a decrease in interest rates benefits stocks, while an increase in rates negatively impacts stocks. But what does the data reveal? First, let’s review S&P 500 performance when the Fed funds rate is rising.

Apart from 2022, rate hikes over the past 40 years were typically tied to pre-emptive strikes against inflation. Though interest rates were rising, economic growth supported profit growth and market performance.

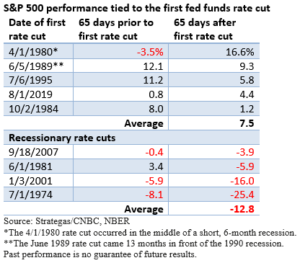

If stocks managed to advance despite rate-hike headwinds, what does the data reveal when the Federal Reserve cuts interest rates? In a nutshell, it was mixed and depended heavily on the economic environment.

Historically, stocks performed well after the first rate cut if a recession was avoided, or, in the case of the 1980 rate cut, stocks rose as investors began to anticipate an economic upturn.

But stocks struggled when rate cuts were in response to weaker economic conditions. While we would never dismiss the impact of Fed policy, the general economic backdrop has historically had a major influence on equities.