Two Graphs and a Data Table…

…And they all come to the same conclusion. What’s going on? The labor market is moving back into balance. No longer do we come across articles touting the Great Resignation. In 2021 and 2022, it was ‘advantage employee.’

Employees still have some leverage, but the pendulum has gradually been swinging back to employers. Of course, this varies from industry to industry, but conditions are generally balanced.

Figure 1 highlights that job openings are back to the pre-pandemic level. They remain elevated but are down sharply from the record high set in March 2022.

Note that the number of unemployed remains below openings. A mismatch in skillsets plays a role, but the gap has narrowed and is near pre-pandemic levels.

The Quits Rate measures what’s called ‘voluntary separations, i.e., those who quit their jobs. It is a measure of labor market confidence for workers.

If help-wanted signs are plentiful, a worker typically feels more confident that he or she can quickly find a new job. The opposite is true if fewer employers are hiring.

Figure 2 illustrates that the Quits Rate remains elevated but is below the pre-pandemic peak.

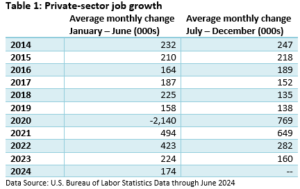

Table 1 averages the monthly change in private-sector jobs from 2014 – 2024, breaking each year into six-month periods: January through June and July through December.

A 174,000 average monthly rise in private-sector jobs this year is the second lowest since 2021 but remains respectable.

Two weeks ago, in testimony on Capitol Hill, Fed Chief Powell said the labor market remains strong but has “softened considerably” and is back to pre-pandemic levels.

While he did not explicitly say the Fed was gearing up for a rate cut, it appears he is laying the groundwork for the first rate cut of the economic expansion, possibly in September.

Market reaction can be summed up in one word: volatility.

Initially, we experienced a rotation out of this year’s winners: the mega-cap stocks and technology, with cash moving into market laggards, including smaller companies, the Dow (which had lagged this year but set new records this week—MarketWatch), and the broader market, which had trailed the large-cap stocks (S&P Dow Jones Indices).

Toward the end of the week, we saw across-the-board declines, and the Dow pared gains.

There have been no changes in the broader economic backdrop, which suggests technical factors and seasonality aided significant gains in the S&P 500 early in the month, and technical factors, including profit-taking, encouraged some selling last week.