From Wallets to Wall Street: Why We Hate Inflation

Why is inflation widely unpopular among the public?

- Inflation erodes the value of money.

- Inflation introduces uncertainty about future prices, making it harder for households to plan budgets, save for long-term goals, or make major purchases.

- Those on fixed incomes—such as retirees—are particularly vulnerable if their income doesn’t adjust to higher prices.

- There is sticker shock when we see prices rise online or at the grocery store.

- Inflation may erode savings.

The public tends to focus not only on how quickly those prices are changing, but also on the current price level—perhaps placing greater emphasis on the current price level.

Why is inflation viewed unfavorably by investors?

- A rise in the rate of inflation can prompt central banks to raise interest rates.

- Rising prices can erode profit margins.

- Inflation can reduce consumers’ real disposable income, leading to weaker demand for goods and services.

- Inflation introduces economic uncertainty, which increases market volatility. Investors tend to demand higher risk premiums, which can lead to lower equity valuations.

- Rising inflation may lead to higher bond yields, which reduces the value of bonds (bond prices and bond yields move in opposite directions).

Investors tend to focus more on the rate of inflation, particularly whether it is accelerating or decelerating, than on the absolute level of prices.

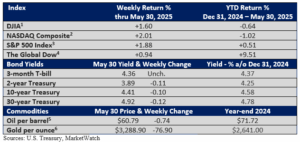

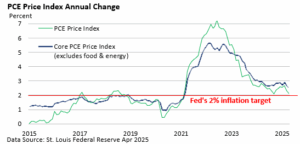

Last week, investors received another dose of good news on inflation.

According to the US Bureau of Economic Analysis, the PCE Price Index was unchanged in April. The core PCE Price Index, which excludes food and energy, rose just 0.1%, the same as March.

While the PCE Price Index is not as widely recognized as the Consumer Price Index, it is similarly a comprehensive measure of price changes across the economy. Notably, the PCE is the Federal Reserve’s preferred gauge of inflation, with a longer-run target of 2.0% annually.

In April, the annual rate slowed to 2.1% from 2.3% in March, and the core rate slowed to 2.5%, which compares to 2.9% in February.

Inflation is trending in the right direction, though evidence that tariffs are meaningfully affecting consumer prices remains largely anecdotal and limited. That could change in the coming months, which is a key reason the Federal Reserve has yet to signal any plans for rate cuts.