Does a Republican Sweep Matter for Investors?

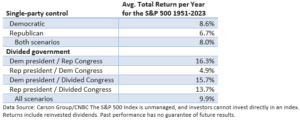

Tables and graphics such as the one below typically surface every four years. While they are interesting, they do not provide much insight, except for the idea that stocks tend to perform well regardless of who occupies the White House and Congress.

As the table illustrates, markets have historically performed slightly better under divided government. On average, the S&P 500 has returned 8.0% under single-party control and 9.9% under divided government (Both/all scenarios category).

Maybe the gridlock that usually ensues from divided government prevents a single party from enacting policies that might hurt the economy.

Based on the recent landscape, stocks have performed well under President Obama, President Trump’s first term, and President Biden, per S&P 500 data from the St. Louis Federal Reserve.

The market’s advance, however, wasn’t without volatility, but volatility has always been a part of the investing landscape.

As we prepare for 2025 and the new administration, the bulls are betting that the upbeat economy will fuel a rise in corporate profits at a time when the Fed is not planning rate hikes.

- From a political perspective, there is no discussion about raising the 21% corporate tax rate, nor is there talk of increasing taxes on the wealthy or taxing unrealized capital gains. Moreover, bullish sentiment is supported by an expected deregulatory push next year.

The bears, however, point to today’s high valuations, the recent rise in bond yields, and expectations for fewer rate cuts in 2025.

- From a political perspective, some concerns that sweeping new tariffs could offset bullish tailwinds from tax policy and deregulation, as higher levies on imports could raise consumer prices at home and invite retaliation against U.S. exporters.

Over an extended period, the economy, corporate profits, inflation, and Federal Reserve policy have been the primary factors influencing the direction of the stock market, not politics.

And profits, inflation, and Fed policy are determined by economic performance.