The Ebb and Flow of Inflation

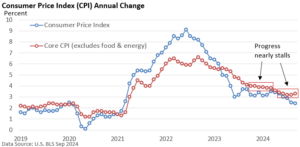

Let’s go granular and jump right into the numbers. Aided by a 1.9% decline in energy prices, the Consumer Price Index released by the U.S. Bureau of Labor Statistics (BLS) rose 0.2% in September. The annual rate slowed from 2.5% in August to 2.4% in September.

The core CPI accounts for 80% of the CPI per the U.S. BLS. It excludes the more volatile food and energy categories. The core CPI rose 0.3% in September. The annual rate accelerated from 3.2% in August to 3.3% in September.

The headline rate is back below the core rate thanks to lower gasoline and oil prices.

While still elevated, note how much inflation has slowed since 2022—from an annual rate of 9.1% to 2.4% for the CPI. Core has been cut in half—from 6.6% to 3.3%. Yet, what economists call ‘the last mile (the return to 2% inflation)’ has been slow. At times, progress has nearly stalled. Let’s call them soft plateaus, as highlighted above.

What brought inflation down? Economists will be debating that question for years. Maybe it goes something like this.

For starters, inflation rose higher and longer than many had anticipated, forcing Fed Chief Powell to ditch his description that the early runup in prices would be “transitory.”

But then, the rate of inflation came down. In part, gasoline is no longer $5 per gallon. In part, inflation sort of really was transitory. But instead of a few months, transitory turned into a couple of years as gummed-up supply chains slowly righted themselves.

One thing we know for sure is that the economy can be shut down as easily as flipping a light switch. Turning it back on is a slow and tortuous process.

If a job-killing recession had occurred in 2023, economists would be saying that the Fed needed to create a recession to lower inflation, similar to the early 1980s. However, the much-predicted recession was a no-show. Unemployment remains low, and the economy continues to expand.

The inflation rate isn’t at the level of the last decade, but it has slowed down without a recession. And for investors, the slowdown helped greenlight a rate cut by the Fed. Meanwhile, modest economic growth supports corporate profits, which underpins stocks.