A Fed Rate Cut and Your Mortgage Rate

A recent online advertisement from a major bank read, “The Fed just lowered interest rates. Could refinancing save you money?”

There is an implicit assumption in the ad that the Fed’s half-percentage point rate reduction brought about a significant drop in mortgage rates shortly following the decision.

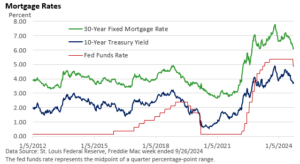

It didn’t. Why not? Changes in the fed funds rate indirectly influence but don’t mirror fixed mortgage rates. Last Thursday, Freddie Mac’s weekly survey pegged the 30-year fixed rate mortgage at 6.08%, down from 6.09% the prior week and 6.20% two weeks ago.

Instead, the yield on the 10-year Treasury bond has the greatest influence. It’s not a one-to-one lockstep relationship, but changes in the 10-year Treasury yield directly impact fixed mortgage rates, as shown below.

While homebuyers and those that may want to refinance may have been disappointed that a big drop in mortgage rates wasn’t forthcoming, rates are down sharply from the 2024 high of 7.22% in early May.

And they are down significantly from August 1, when the 30-year stood at 6.73%.

What else influenced the summer’s decline in mortgage rates?

In addition to the 10-year Treasury, there was increased speculation about a rate cut by the Fed during the summer, which contributed to the decrease in Treasury yields. The softer labor market and the slowdown in the rate of inflation also influenced the decline in yields.

Plus, demand for mortgage-backed securities, which are bundled by lenders and sold on the secondary market, can affect rates.

If demand for these securities is high, rates may come down slightly. When demand falls off, rates may tick higher to attract buyers.