US Exceptionalism

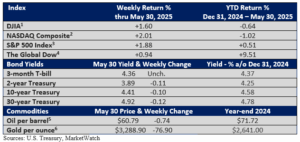

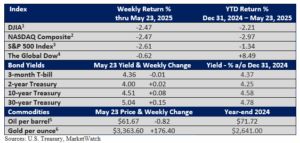

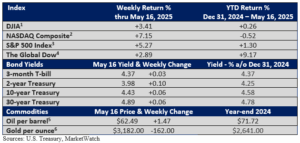

Discussions of U.S. exceptionalism in the stock market stem from the consistent outperformance of major U.S. indexes compared to global markets. For example, over the past decade, the Global Dow is up about 103%, while the S&P 500 Index has risen by 180%, according to S&P Global (excluding reinvested dividends, April 30, 2015 – May 22, 2025).

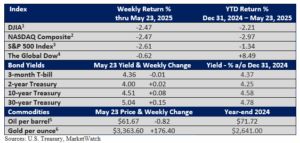

Since the start of the year, overseas markets have outperformed, as evidenced by the Global Dow.

A brief phase of market outperformance doesn’t automatically signal the decline of U.S. exceptionalism, as some have opined. In truth, measuring US exceptionalism solely through stock market performance is too narrow a perspective.

So, let’s provide a working definition. US, or American, exceptionalism is the belief that the nation’s history, values, and political system set it apart, suggesting that the US has a unique role to fulfill on the global stage.

America’s institutions play a key role in shaping and reinforcing the idea of American exceptionalism. These structures contribute to the nation’s stability, global influence, and unique identity. These include:

Three equal branches of government prevent authoritarian rule and reinforce democracy.

The rule of law protects individual and property rights, supporting economic stability.

The deepest and most transparent capital markets in the world attract capital from overseas.

Strong institutions, including an independent Federal Reserve, reinforce economic strength.

The world’s largest economy influences global trade, finance, and innovation, supporting the nation’s leadership role.

The US is home to many top universities, fostering intellectual leadership, technological advancements, and global influence in research and education.

The US dollar is the world’s reserve currency, and most commodities, including oil, are priced and traded in dollars (with few exceptions).

Last week, the Wall Street Journal noted that privately owned tech firms in the US valued at more than $1 billion have an estimated combined market value of $2.5 trillion, significantly surpassing China ($703 billion) and Europe ($333 billion).

Domestic innovation, according to LPL Research, “continues to rise to new heights as the US has long been a leader in technological advancements, thanks to substantial investments in research and development, a robust higher education system, and a dynamic entrepreneurial ecosystem.”

Yet, short-term stock market performance is shaped by a range of factors. While the possibility of market corrections and bear markets remains a consideration, the unique strengths of the US economy continue to attract foreign investment and reinforce confidence in American markets.

Despite inevitable challenges, this has placed the US in an enviable position. So, as we reflect on the holiday weekend, let’s remember that on Memorial Day, we honor the brave men and women who gave their lives in service to our country. Their sacrifice and courage ensure the freedoms we cherish today.