Is Your Life Insurance Aligned with the Life You’re Living Today?

Comprehensive. Ongoing. Built Around You.

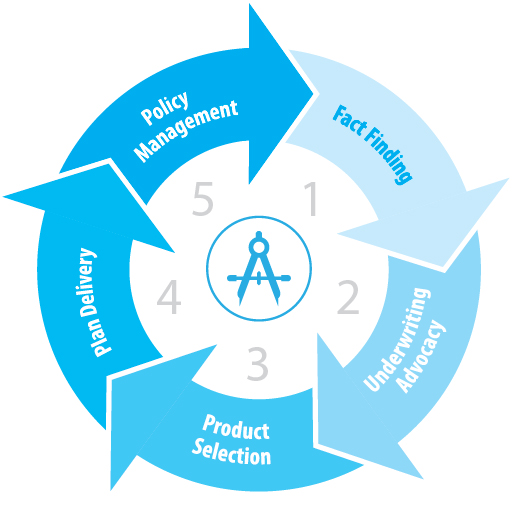

Life Assurance 360™ isn’t just a one-time transaction—it’s a unique five-step process designed to help you choose, implement, and manage a policy that grows with your life.

From gathering the right information to regularly reviewing your policy’s performance, we help ensure your life insurance stays aligned with your evolving goals.

Here’s How It Works

Each step is designed to give you more clarity and confidence. Here’s what you can expect:

We start with two simple questionnaires that help us understand what matters to you—your goals and risk tolerance to assess how life insurance could fit into your overall plan. This step sets the foundation for a policy designed specifically around your life.

Before applying, our team works behind the scenes to gather and clarify your medical information. For high-net-worth clients or those with complex health histories, we offer a discreet private evaluation—protecting your identity while optimizing your underwriting outcome.

Once we know your needs and your risk profile, we compare policies based on five factors: safety, flexibility, equity, certainty, and premium. Our recommendations reflect what matters most to you—not what sells best.

We translate technical comparisons into clear, personalized insights. You’ll get plan options laid out in a format that empowers you to make an informed, confident decision.

Your life changes—and so should your coverage. Our ongoing reviews track performance, flag concerns, and help ensure your policy stays aligned with your needs for the life of the plan.

Protecting Your Family from the Hidden Costs of Aging

With people living longer, extended health care is becoming a reality for many—and one of the greatest risks to retirement income. Without proper planning, long-term care can quickly drain assets and put pressure on loved ones.

We offer hybrid life insurance policies that include long-term care benefits—giving you a way to:

- Cover care costs without liquidating your savings

- Provide emergency funds for loved ones

- Leave a legacy to family or charity, even after care needs arise