Market Commentary, April 29, 2024

The Economy Slows, Inflation Remains a Problem

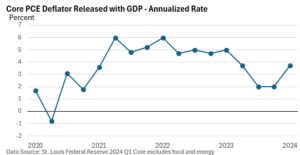

Gross Domestic Product (GDP) is the broadest measure of goods and services. The U.S. Bureau of Economic Analysis (BEA) reported that GDP slowed from Q4’s annual pace of 3.4% to 1.6% in Q1.

Per the U.S. BEA data, consumer spending eased but remained respectable, while business outlays and residential construction accelerated. A jump in imports shaved one percentage point off GDP. Notably, it’s still too soon to say whether Q3 and Q4’s jump in GDP was just an anomaly.

One-off factors can sometimes add or detract from GDP. In Q1, they detracted, and the 1.6% rate came in below projections, according to Bloomberg News.

Meanwhile, inflation picked up, as a closely watched measure of underlying inflation rose at a greater-than-expected annualized pace of 3.7%— see graphic below.

Stagflation? That term has popped up a number of times over the last 30 years.

Yes, growth slowed, and inflation accelerated. But it’s only one quarter, and one quarterly data point doesn’t make a trend. Still, inflation is a problem, especially in the service sector, which is more resistant to Fed policy. Few see a rate cut anytime soon.

Market Commentary, April 22,2024

Just Do It

That ubiquitous phrase from one of America’s most extensive athletic footwear and apparel makers seems to have been adopted by most American shoppers.

The U.S. Census Bureau reported last week that retail sales jumped 0.7% in March, following a strong 0.9% rise in February.

These numbers add to a bundle of recent economic data that is throwing cold water on the idea that the Federal Reserve will proceed with its first rate cut in June.

Why are retail sales important? Consumer spending accounts for almost 70% of total U.S. economic activity. While retail sales exclude services, they include the goods you and I purchase at stores and online. Automobiles are also included.

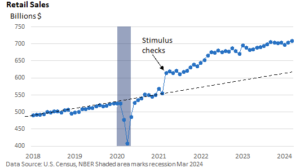

The graphic below illustrates the trend in retail sales since 2018. The lockdown and ensuing recession sent sales at most retailers down sharply. As you probably recall, some big box retailers, which were considered essential, did quite well.

Note the sharp jump in sales in early 2021. Recall that $1,400 per-person stimulus checks were sent to households via the American Rescue Plan (ARP). A family of four received up to $5,600 if within the ARP’s income limits.

Some saved or paid down debt; others went on a spending spree. The graphic illustrates that spending never returned to or approached pre-stimulus levels.

The stimulus checks did what they were designed to do at the time—stimulate spending.

However, as supply chain constraints were hampering global and U.S. production, strong consumer spending added to bottlenecks and contributed to inflation at the time.

Families haven’t received a stimulus check in quite a while. But businesses are hiring and families are spending. For now, the economy is expanding.

Market Commentary, April 15, 2024

The Road to Lower Inflation Takes a Detour

The rate of inflation is accelerating. That’s not how we hoped to start this week’s Insights.

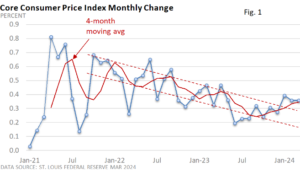

Take a moment and review Figure 1. The 4-month moving average has broken out of its long-term downward trend (red-dashed lines). On a monthly basis, prices bottomed in June and began to gradually turn higher. The upward trajectory picked up in January.

But, what about the so-called calendar effect? Wasn’t the bump in January and February tied to the new year? Well, apparently not.

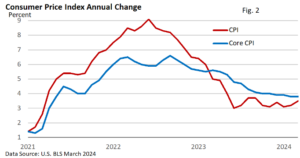

The Consumer Price Index rose 0.4% in March. It’s up 3.5% versus one year ago. In February, it was up 3.2%.

The core rate, which excludes food and energy, rose 0.4%. It’s up 3.8% year-over-year, the same as February—see Figure 2.

Inflation has slowed dramatically on an annual basis. That is important to acknowledge. But price hikes remain elevated. Using the year-over-year rates as our yardstick, progress toward price stability (defined by the Federal Reserve as 2% annually) has stalled.

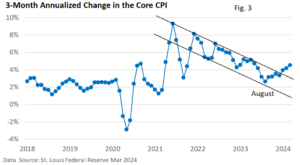

Let’s review another metric. The 3-month annualized rate can be noisier and more volatile, but it can detect new trends faster than the year-over-year rate. Like the monthly core CPI, it has also turned higher, bottoming out at 2.64% in August and rising to 4.53% in March. It has risen in six of the last seven months.

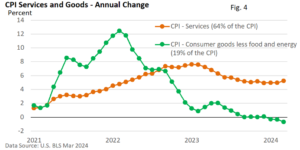

What’s happening? U.S. BLS data highlight that the price of consumer goods, excluding food and energy, are declining—yes, that’s right, declining. Goods are in a slight deflationary trend (Figure 4). But services are much higher and are showing signs of accelerating.

At best, the road to lower inflation isn’t hitting bumps; it’s taken an unexpected detour. At worst, inflation is moving higher, and we’re repeating the mistakes of the 1960s and 1970s. Or will inflation get stuck in the current range, denying the Fed the ability to start cutting rates?

Following the runup in stocks, some volatility shouldn’t be discounted. The latest CPI report is forcing a shift in sentiment on rate cuts, which is creating short-term volatility.