Front-Running Tariffs Distort GDP The U.S. Bureau of Economic Analysis (BEA) reported that first quarter…

Market Commentary, Q1 2025

Tariff Talk Leads to a Market Correction

“Here’s the interesting thing about the stock market: …It has no gender, ethnicity, or religion… “It’s the ultimate voting machine, reflecting prospects for earnings growth, stability, liquidity, inflation, taxation, and predictable rule of law.” –Michael Cembalest, JPMorgan – 3/12/25

When controversial topics impact market activity, our goal is to preserve objectivity by examining them from an investor’s perspective. In other words, how might events, both economic and non-economic, affect the “prospects for earnings growth, stability, liquidity, inflation, taxation, and predictable rule of law.” This includes tariffs.

Our expertise lies in partnering with you to create and implement financial plans that help you achieve your long-term financial objectives. When domestic or international events impact market action, we aim to convey their impact — what and why — without the shrill headlines sometimes found in the financial press.

Highs followed by a correction

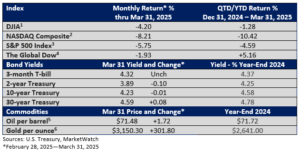

Last month, the market was riding high, and the S&P 500 Index achieved a record close during the second half of February, according to MarketWatch.

In essence, investors didn’t appear to believe the president would follow through on his threat to levy tariffs. Instead, they seemed to view it as a strategy to gain concessions. If push came to shove, he’d relent.

While he has delayed levies on some countries and products, some tariffs have been implemented, generating significant uncertainty.

The most immediate impact is the first 10% pullback in the S&P 500 Index since the second half of 2023, occurring at the recent low on March 12th, according to data from MarketWatch.

Yet, market corrections are common. The average intra-year decline in the S&P 500 Index since 1980 is 14%, according to LPL Research. So far, the S&P 500’s decline has been a modest 10.1%.

Today, investors are re-pricing assets in lieu of the additional uncertainties.

As Mr. Cembalest noted in his research report, “Market consensus had assumed the administration would carefully balance inflationary, anti-growth policies with pro-growth policies. (Instead), it has come storming out of the gate with more of the former than the latter.” Consequently, market volatility has ensued.

Investors and financial markets view trade barriers as an impediment to economic growth.

- Tariffs may boost inflation. While many expect this to be a one-time boost, concerns have been raised about potential longer-lasting or secondary effects—discuss in a moment.

- Tariffs may slow economic growth as trading partners retaliate by erecting walls to U.S. exports.

- While higher barriers to U.S. markets might benefit some domestic industries, overall, however, tariffs lead to increased economic uncertainty, which can undermine business confidence and business spending.

In summary, might we see slower economic growth, leading to slower profit growth, AND higher prices? That possibility is encouraging investors to re-price assets, i.e., modestly lower stock prices.

Tariffs and inflation

Currently, Fed officials are in the ‘one-time price boost’ camp. That’s one significant reason why the Fed believes it can overlook tariffs and refrain from raising interest rates to combat inflation. Fed Chair Powell even used the term “transitory” last month when referencing any tariff-induced inflation.

The term ‘transitory’ makes economists and investors somewhat uneasy, as it was used to characterize inflation in 2021. As the economy reopened, prices jumped. The surge in inflation was expected to be transitory (temporary), according to Fed officials, until, well, it wasn’t.

We conceptually understand the one-and-done price hikes. Tariff is levied, price rises (something akin to a sales tax increase, though the mechanics are much different), and that’s it.

But what about secondary effects? If tariffed auto prices rise sharply, would domestic manufacturers also raise their prices, forsaking market share for fatter profit margins? Would higher costs for new cars prompt some to consider used vehicles, driving prices higher? Therefore, would auto insurance also rise? Maybe, or maybe not. It’s complicated.

These exercises can be re-created in many industries. But they are speculative. The end game is unknown; hence, there is a high degree of uncertainty.

Investor’s Corner

Stocks have risen sharply over the past two years. Yet, we are mindful that market volatility may be unsettling, and we encourage a longer-term perspective that avoids decisions based solely on recent market action.

Be cautious about trying to time the market. Market timers occasionally get lucky. But consistently timing peaks and valleys is nearly impossible. Further, wealth creation is about time in the market, not timing the market.

Your financial plan encourages you to make more thoughtful investing decisions, removing the emotional component that may cloud decision-making when stocks are surging or volatility surfaces.